Seller's Guide

D2N.in Seller's Guide

Effective Date: 17-March-2025

Last Updated: 17-March-2025

1. Welcome to D2N.in

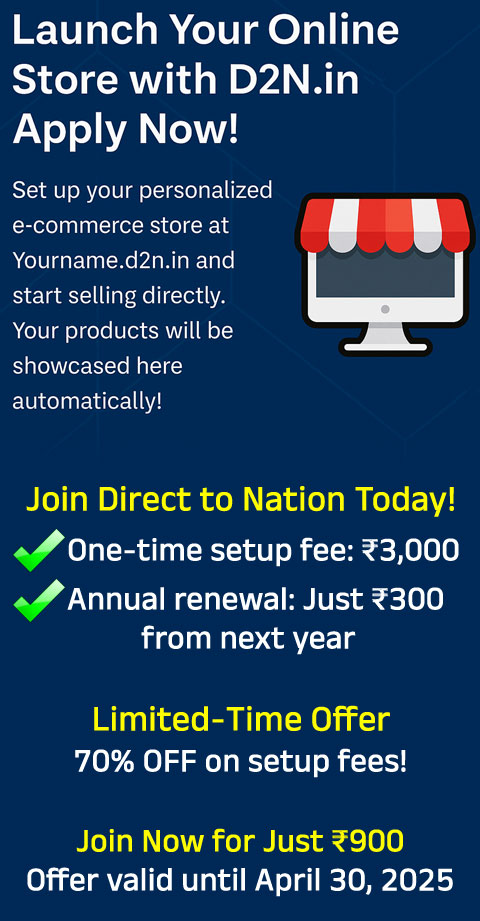

D2N.in is a commission-free online selling platform that enables businesses to create their own subdomain store, list products, and sell directly to customers. This guide will help you set up your store, list products, manage orders, and maximize your sales.

2. Getting Started

Step 1: Register Your Business

- Visit www.d2n.in and click on "Apply for a Business Account."

- Fill out your business details and complete the verification process.

- Once approved, you will get your own online store (yourname.d2n.in).

Step 2: Set Up Your Store

- Upload your business logo, banner, and contact details.

- Add shipping, return, and warranty policies to your store page.

- Set up your preferred payment methods (UPI, bank transfer, etc.).

3. Listing Products

Step 1: Add Products to Your Store

- Go to your Seller Dashboard and click "Add Product."

- Upload high-quality images and write clear descriptions.

- Set your selling price, stock availability, and delivery time.

Step 2: Optimize Listings for Sales

- Use relevant keywords in product titles and descriptions.

- Highlight key features, benefits, and offers.

- Ensure your product pricing is competitive.

4. Order Management

Step 1: Receive & Process Orders

- You will receive an order notification via email and dashboard.

- Verify the payment received from the customer before processing.

Step 2: Shipping & Delivery

- Pack products securely and ship them using your chosen courier service.

- Provide tracking details to the customer (if applicable).

- Communicate estimated delivery time with the buyer.

5. Payments & Earnings

- Payments go directly to your account—D2N.in does not hold any payments.

- There are no commission charges, so you keep 100% of your earnings.

- Ensure you have clear pricing and refund policies to avoid disputes.

6. Customer Communication

- Respond to customer inquiries promptly and professionally.

- Provide clear information on shipping, returns, and product details.

- Address complaints or disputes quickly to maintain a good reputation.

7. Returns & Refunds

- Clearly state your return and refund policy on your store page.

- If a return is requested, process it according to your policy.

- Keep good records of transactions and communicate with customers transparently.

8. Marketing & Promotions

- Share your store link on WhatsApp, Facebook, and social media.

- Offer discounts, bundle deals, or free shipping to attract customers.

- Utilize D2N.in’s marketing tools for better visibility.

9. GST & Compliance Guidelines for D2N.in Vendors

9.1 GST Registration Requirement Vendors must determine their GST registration requirements based on the following conditions:

When GST Registration is Mandatory:

- Interstate Sales: If you sell outside your home state, GST registration is required.

- Annual Turnover Above GST Limit: ₹40 lakh for goods (₹20 lakh for special category states).

- Selling Taxable Goods: If your products attract GST, you must register.

- B2B Sales: If you sell to businesses requiring GST invoices, registration is required.

When GST Registration is Not Required:

- Only Intrastate Sales Below Threshold: If you sell within your state and turnover is below ₹40 lakh (₹20 lakh for special states).

- Selling Exempted Goods: Products like fresh produce, books, and unbranded food items are GST-exempt.

- Small-Scale Individual Sellers: Individuals with minimal sales can continue without GST registration if they qualify for exemptions.

9.2 Tax Compliance Responsibility

- Vendors must comply with GST laws according to their business model.

- D2N.in does not handle GST collection, tax filing, or compliance.

- GST-registered vendors must issue invoices with GST.

- Non-GST registered vendors cannot charge GST on their sales.

9.3 Platform’s Role & Liability

- D2N.in is NOT an e-commerce operator under GST law.

- Vendors are solely responsible for tax compliance, invoicing, and filing returns.

- D2N.in is not liable for vendor tax compliance or legal actions.

9.4 Vendor Declaration By using D2N.in, vendors confirm that they:

- Understand and comply with GST laws.

- Register for GST if required based on their business.

- Take full responsibility for their tax obligations.

10. Growing Your Business

- Keep adding new products regularly.

- Maintain competitive pricing and provide great customer service.

- Monitor your sales performance and adjust strategies accordingly.