GST & Compliance Guidelines

GST & Compliance Guidelines for D2N.in Vendors

Effective Date: 17-03-2025

Last Updated: 17-03-2025

1. Introduction

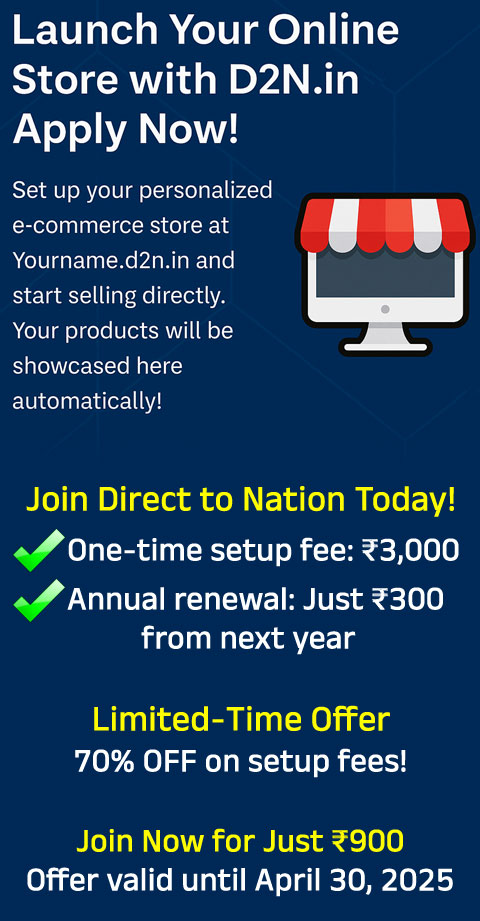

D2N.in is a platform that provides vendors with a personalized e-commerce website (e.g., vendorname.d2n.in) to list and sell their own products directly to customers.

D2N.in does not act as an e-commerce operator and is not involved in payments, order processing, or shipping. Vendors are responsible for their own business operations, including compliance with tax laws.

2. GST Registration Requirement for Vendors

Vendors using D2N.in must determine whether they are required to register for Goods and Services Tax (GST) based on the following conditions:

2.1 When GST Registration is Mandatory

- Interstate Sales → If a vendor sells products to customers outside their home state, GST registration is compulsory, regardless of turnover.

- Turnover Above GST Limit → If a vendor’s annual sales exceed:

- ₹40 lakh for goods (₹20 lakh for special category states), GST registration is mandatory.

- Selling Taxable Goods → If a vendor sells products that attract GST (e.g., electronics, apparel, etc.), they must register and charge GST.

- B2B Sales (GST Invoice Requirement) → If a vendor sells to businesses that require a GST invoice, GST registration is required.

2.2 When GST Registration is Not Required

❌ Only Intrastate Sales Below Threshold → If a vendor sells only within their state and has a turnover below ₹40 lakh (₹20 lakh for special states), GST registration is not mandatory.

❌ Selling Exempted Goods → If a vendor only sells GST-exempt products (e.g., fresh produce, books, unbranded food items), they are not required to register.

❌ Small-Scale Individual Sellers → Vendors operating as individuals with minimal sales can continue without GST registration if they meet the exemption criteria.

3. Tax Compliance Responsibility

- Vendors must comply with GST laws based on their business operations.

- D2N.in does not handle GST collection, tax filing, or compliance on behalf of vendors.

- Vendors must issue GST invoices to customers if they are GST-registered.

- Vendors without GST registration cannot charge GST on their sales.

4. Platform’s Role & Liability

- D2N.in is NOT an e-commerce operator under GST law.

- We do not mandate GST registration for all vendors, but vendors must follow applicable tax laws.

- Vendors are solely responsible for tax compliance, invoicing, and returns filing.

- D2N.in is not liable for any non-compliance, penalties, or legal actions arising from vendors’ tax obligations.

5. Vendor Declaration

By using D2N.in, vendors confirm that they:

- Understand GST laws and will register if required.

- Will comply with all applicable tax and regulatory requirements.

- Are solely responsible for their tax obligations.

6. Need Help?

For tax-related queries, vendors should consult a qualified tax professional or refer to official GST resources from the Government of India (https://www.gst.gov.in/).